Vietnam chemical import guide: mandatory documents, customs & compliance checklist

Vietnam has positioned itself as a global manufacturing hub, driving an unprecedented demand for raw materials. From industrial solvents for textiles to specialized compounds for electronics, the volume of chemicals entering Vietnamese ports is skyrocketing.

However, for many people, importing chemicals into Vietnam is widely considered one of the most complex logistical challenges. Unlike general cargo, chemical imports sit at the intersection of trade law, environmental safety, and fire prevention regulations. A single discrepancy in your Material Safety Data Sheet (MSDS) or a missing GHS label can lead to shipments being held at port for weeks, incurring massive Demurrage & Detention (DEM/DET) charges, or even forcing re-export.

This guide serves as your essential checklist. We break down the latest regulations-including the critical updates in Decree 82/2022/ND-CP-to help you navigate the Vietnam National Single Window and clear customs without delays.

The legal framework: Understanding the “Big Three”

Before shipping a single container, it is crucial to understand the hierarchy of laws that govern chemical safety in Vietnam. The customs officers do not merely check for tax compliance; they check for safety compliance based on these three pillars:

- The Law on Chemicals 2025: This is the supreme law that sets the foundation for chemical definition, classification, and lifecycle management in Vietnam

- Decree 113/2017/ND-CP: For years, this was the “bible” for chemical importers. It detailed the specific lists of chemicals subject to declaration or restriction

- Decree 82/2022/ND-CP (The Game Changer): Effective from late 2022, this decree amended and supplemented Decree 113. Crucial Note: If you are using an old guide from 2020 or 2021, you are likely non-compliant. Decree 82 updated the lists of chemicals and changed reporting thresholds (e.g., exemptions for small quantities in specific mixtures)

Why does this matter? Because Vietnamese Customs and the Ministry of Industry and Trade (MOIT) use these decrees to decide if your cargo requires a simple online declaration or a complex government license.

Full process to import chemicals into Vietnam

Step 1: Pre-Import Classification (The CAS Number Rule)

The most common mistake in chemical logistics is assuming the Commercial Name is enough. It is not. To clear customs in Vietnam, you must classify your goods based on their chemical composition.

a. The Power of the CAS Number

The CAS number (Chemical Abstracts Service) is the universal ID for chemicals. Vietnamese regulations link specific regulations to CAS numbers, not trade names.

Example: You might call your product “Super Clean 3000”, but Customs cares that it contains “Methanol” (CAS 67-56-1).

b. Which list does your chemical belong To?

Based on Decree 113 and Decree 82, your chemical will fall into one of these categories:

- List V – Chemicals Subject to Declaration: This is the most common category for industrial chemicals. You do not need a “license,” but you must declare the shipment on the National Single Window system before customs clearance.

- List I, II, III – Restricted or Conditional Chemicals: These are hazardous or toxic chemicals (e.g., precursors for explosives, industrial precursors). Importing these requires a License/Permit issued by the MOIT or related ministries (Ministry of Health, Ministry of Public Security).

- New Exemptions (Decree 82): Some mixtures containing regulated chemicals may be exempt from declaration if the concentration is below a certain threshold (often 0.1%), preventing unnecessary paperwork.

Step 2: The mandatory documents checklist

For a standard general cargo shipment, a Bill of Lading and Invoice might suffice. For chemicals, the document pack is much more extensive. Missing any of the following will result in a rejected customs declaration.

a. Standard Commercial Documents

- Bill of Lading (B/L): Must match the commercial invoice exactly.

- Commercial Invoice & Packing List: Must clearly state the gross weight, net weight, and UN number (if Dangerous Goods).

- Certificate of Origin (C/O): Essential for tax reduction. Vietnam has FTAs with many regions (Form E for China, Form EUR.1 for Europe, etc.).

b. Chemical-specific documents (Non-Negotiable)

1. Material Safety Data Sheet (MSDS)

This is the most critical document.

- The Standard: Must follow the GHS (Globally Harmonized System) format with 16 standardized sections.

- The Language: Vietnamese Law requires the MSDS to be in Vietnamese. While Customs may accept an English version for initial review, market surveillance agencies and transport companies strictly require the Vietnamese version for safety.

- The Content: It must show the CAS number, physical hazards, and first-aid measures.

2. Certificate of Analysis (COA)

Customs officers are not chemists. They rely on the COA to verify the composition percentages declared. If your COA says “Methanol 99%” but you declare “Solvent Mixture,” you will face penalties for false declaration.

3. Proof of Chemical Declaration

For List V chemicals, after you submit your data to the MOIT system, you will receive a digital System Response (receipt). This digital code or printout is required to open the official Customs Declaration (Tờ khai hải quan).

4. Import License (Giấy phép nhập khẩu)

Only applicable if your goods fall under Restricted Lists (List I, II, III). This must be obtained months before the shipment departs the origin port.

Step 3: The declaration process via National Single Window

Vietnam has modernized its procedure through the National Single Window (vnsw.gov.vn). Here is the step-by-step workflow for a standard chemical shipment:

Account Registration: The Vietnamese importer must register an account on the VNSW portal and possess a digital signature (Token/Chữ ký số).

Online Declaration (Before customs Clearance)

- Timing: You should declare as soon as you have the final documents, even while the vessel is at sea.

- Submission: Upload the Invoice and MSDS. Fill in details: Exporter, Importer, Chemical Name, HS Code, CAS Number, Purpose of Import.

System Processing:

- Auto-Approval: For many standard chemicals, the system is automated. If the data matches the database, it returns a Registration Code immediately.

- Manual Review: For sensitive chemicals, a specialist from Vinachemia (Vietnam Chemicals Agency) may review the file. This can take 1-3 working days.

Customs Clearance (VNACCS/VCIS):

Once you have the Registration Code from the Single Window, you input this code into the “Licenses/Documents” field on the E-Customs declaration software (ECUS/VNACCS). Without this code, the system will verify that the HS Code requires a permit and will block the clearance (Red Channel or Yellow Channel).

Step 4: Compliance with GHS Labeling

Even if your paperwork is perfect, you can still get fined during the physical inspection. Why? Labeling errors. Decree 111/2021/ND-CP and Circular 17/2022/TT-BCT are very strict about labels.

Mandatory Elements on the Label:

- Chemical Name: In Vietnamese.

- Origin: “Made in…” or “Xuất xứ:…”

- Importer Information: Full name and address of the Vietnamese entity responsible for the cargo.

- Date of Manufacture / Expiry Date.

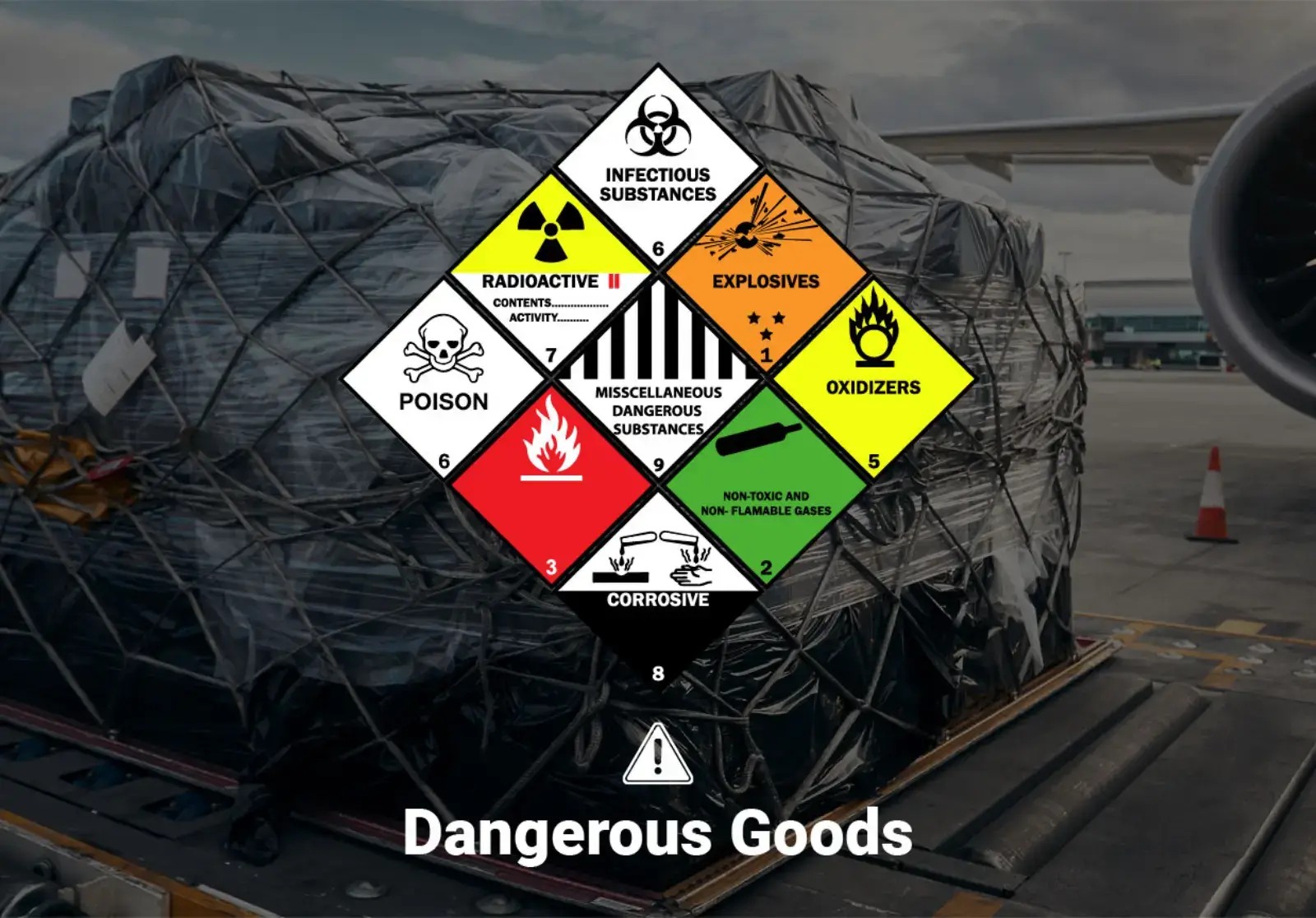

- GHS Pictograms: Diamond-shaped hazard symbols (Flammable, Corrosive, Toxic, etc.).

- Signal Words: “DANGER” (Nguy hiểm) or “WARNING” (Cảnh báo).

- Hazard Statements: Phrases describing the nature of the hazard.

FASTRANS Marketer Tip: We recommend sending the label design to your Logistics Provider to review before the goods are stuck on the container. Correcting labels at the port is expensive and time-consuming.

Logistics for Dangerous Goods (DG)

If your chemical is classified as Dangerous Goods (DG) under IMO regulations (e.g., Class 3 Flammable Liquids, Class 8 Corrosives), the physical movement of goods is as important as the paperwork.

a. Port Handling

Not all ports in Vietnam handle all classes of DG. For example, Cat Lai Port (HCMC) or Hai Phong Port generally handle standard DG, but highly explosive or specific radioactive materials may require specialized terminals.

Direct Delivery (Hàng rút ruột cầu tàu): Some ports do not allow DG containers to stay in the yard (CY) due to explosion risk. They require the truck to be present at the ship’s side to take the container immediately upon discharge.

b. Inland Trucking

You cannot use a standard truck for DG cargo. There will be some special requirements:

- Drivers: Must hold a certificate for transporting dangerous goods.

- Vehicles: Must be equipped with fire extinguishers, warning signs (placards), and spill kits.

- Permits: A valid license for transporting dangerous goods issued by the Police or Department of Transport is required.

Common Pitfalls & How to Avoid Them

1. The “Name Game” Discrepancy:

The Invoice says “Industrial Solvent A,” the MSDS says “Polymer Mixture,” and the Label says “Cleaning Solution.”

Solution: Ensure consistency across ALL documents. The Commercial Name and Chemical Name must be aligned.

2. Ignoring Decree 82 Exemptions

Importers often declare chemicals that are actually exempt under the new Decree 82 (e.g., small testing samples or low-concentration mixtures), wasting time and administrative resources.

Solution: Consult with a logistics expert to analyze the composition against the latest Annexes.

3. Missing the “Pre-Arrival” Declaration window

Waiting until the ship arrives to start the Chemical Declaration on the Single Window. If the system rejects your application for a typo, your cargo sits at the port incurring storage fees.

Solution: Start the declaration process 3-5 days prior to arrival.

Conclusion

Importing chemicals to Vietnam is a procedure that rewards preparation and punishes assumptions. The regulatory environment, anchored by Decree 113 and Decree 82, demands precise classification, verified documentation, and strict adherence to safety labeling.

By following this checklist-classifying correctly via CAS numbers, securing the MSDS in Vietnamese, and utilizing the National Single Window early-you can transform a complex headache into a streamlined supply chain advantage.

Navigating the gray areas of chemical composition and customs law can be difficult. At FASTRANS, we specialize in DG and Chemical handling. From obtaining import licenses to specialized DG trucking, we ensure your cargo moves safely and legally.