Vietnam C/O Form D procedure: A step-by-step guide for exporters

In the dynamic landscape of international trade, the ASEAN Economic Community (AEC) represents one of the most vibrant markets for Vietnamese exporters. With intra-bloc trade volume surging year over year, leveraging the benefits of the ASEAN Trade in Goods Agreement (ATIGA) is no longer optional-it is a strategic necessity.

At the heart of this agreement lies a critical document: the Certificate of Origin (C/O) Form D.

For logistics managers and export directors, understanding the nuances of C/O Form D is the key to unlocking competitive pricing. By reducing import duties to 0% for your buyers, you effectively lower the landed cost of your products without sacrificing your profit margins.

What is C/O Form D?

C/O Form D is a Certificate of Origin issued for goods originating from ASEAN member states to claim preferential tariff treatment under the ATIGA agreement. When a Vietnamese exporter provides a valid Form D to an importer in another ASEAN country, that importer can claim a significant reduction in import duties (mostly down to 0%).

Applicable countries

This form is strictly used for trade between the 10 ASEAN member states:

- Vietnam

- Singapore

- Thailand

- Malaysia

- Indonesia

- Philippines

- Brunei

- Cambodia

- Laos

- Myanmar

Why is c/o form d critical for your business?

From a supply chain perspective, C/O Form D is a tool for Landed Cost Optimization.

- Tariff Elimination: Under ATIGA, nearly 99% of tariff lines have been eliminated

- Competitive Advantage: If you export Vietnamese coffee to Thailand, having a Form D allows your Thai buyer to pay 0% tax. If your competitor from outside ASEAN (e.g., Brazil) exports the same product, the buyer might pay 30-40% tax. This makes your product significantly more attractive

- Faster Customs Clearance: With the implementation of the ASEAN Single Window (ASW), the electronic exchange of Form D accelerates the release of cargo at the destination port

The c/o form D application procedure (update)

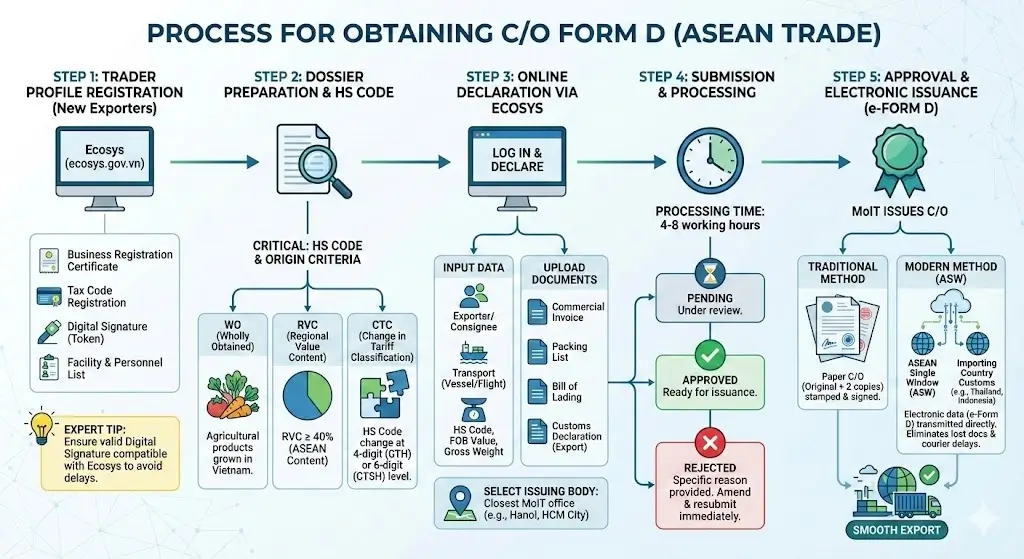

Step 1: Trader profile registration (For new exporters)

If this is your first export shipment, you must register a trader profile on the Electronic Certificate of Origin Issuance System (Ecosys) at ecosys.gov.vn.

Required data includes:

- Business Registration Certificate.

- Tax Code registration.

- Digital Signature (Token) registration.

- List of manufacturing facilities and personnel.

Expert Tip: Ensure your digital signature is valid and compatible with the Ecosys platform to avoid technical delays during urgent shipments.

Step 2: Dossier preparation & HS code determination

Before logging into the system, the logistics team must prepare the “meat” of the application. The most critical aspect here is the HS Code (Harmonized System) and the Origin Criteria.

You must determine which criteria your goods qualify for:

- WO (Wholly Obtained): Agricultural products grown and harvested entirely in Vietnam.

- RVC (Regional Value Content): The goods have at least 40% ASEAN content (RVC ≥ 40%).

- CTC (Change in Tariff Classification): The manufacturing process results in a change in the HS Code at the 4-digit (CTH) or 6-digit (CTSH) level.

Step 3: Online declaration via ecosys

➡Log in to the Ecosys system and declare the shipment details.

➡Input Data: Exporter details, Consignee, Transport details (Vessel name/Flight No.), HS Code, FOB Value, and Gross Weight.

➡Upload Documents: Attach scanned copies of the Commercial Invoice, Packing List, Bill of Lading, and Customs Declaration (Export).

➡Select Issuing Body: Choose the MoIT office closest to your business location (e.g., Hanoi, Ho Chi Minh City, Hai Phong, Da Nang).

Step 4: Submission and Processing

Once submitted, the system will assign a C/O Reference Number. The MoIT specialists will review the dossier.

- Processing Time: typically 4 to 8 working hours for electronic submissions.

- Status Updates: You must monitor the status regularly.

- Pending: Under review.

- Approved: Ready for issuance.

- Rejected: The officer will provide a specific reason (e.g., “Incorrect HS Code” or “Insufficient cost breakdown”). You must amend and resubmit immediately.

Step 5: Approval & Electronic Issuance (e-Form D)

Upon approval, the MoIT issues the C/O. The electronic data (e-Form D) is transmitted directly to the Customs system of the importing country (e.g., Thailand or Indonesia) via the ASEAN Single Window. This eliminates the risk of lost documents and courier delays.

Required documents for the application

To ensure a “Green Channel” approval (fast-tracking), your dossier must be accurate and consistent.

- Application for C/O Issuance: Printed from Ecosys, signed and stamped.

- Export Customs Declaration: Must be “Cleared” status.

- Commercial Invoice & Packing List: Final versions matching the B/L.

- Bill of Lading (B/L) or Air Waybill (AWB): Confirming the departure date.

- Evidence of Origin:

- Manufacturing Cost Statement: Showing the calculation of RVC (if applicable).

- Purchase Invoices: Proving the source of raw materials (local or imported).

- Production Process Flowchart: Explaining how raw materials are transformed into the final product.

Common pitfalls & expert advices

As a logistics provider, we often see C/O applications rejected due to avoidable errors. Here is how to protect your shipment:

Discrepancy in HS Codes: The HS Code on the C/O must match the HS Code declared by the importer at the destination. A mismatch between the Vietnam Export Declaration and the Destination Import Declaration is the #1 reason for rejected C/O Form D.

➡ Solution: Always confirm the HS Code with your buyer before applying for the C/O.

FOB Value Calculation: For RVC criteria, the FOB value must be stated accurately. Many exporters confuse Ex-Works price with FOB price.

➡ Solution: Ensure domestic transport and handling charges are included in the final FOB value declared on the C/O.

Retroactive Issuance: If you apply for the C/O after 3 days from the flight/vessel departure date, the C/O must be marked as “ISSUED RETROACTIVELY”. Failure to tick this box will render the document invalid at the destination customs.

A valid C/O Form D is more than just paperwork; it is a promise of quality and a direct financial benefit to your partners.

Do you need professional assistance with your Customs Declaration and C/O Form D application? At Fastrans, we specialize in navigating complex logistics regulations to ensure your cargo moves faster and smarter. Contact our support team today for a consultation on your specific commodity.