The comprehensive guide to logistics cost at Noi Bai airport (HAN)

Air freight is the undisputed champion of speed in global trade. For factories, manufacturers, and trading companies operating through Vietnam, Noi Bai International Airport (HAN) serves as a critical gateway. However, this speed comes with a complex and often opaque fee structure. Understanding the total logistics cost-beyond the simple freight rate-is crucial for effective budgeting, competitive pricing, and sustainable business operations.

This definitive guide, written by Fastrans, provides a granular breakdown of the four major cost categories you must navigate when importing or exporting cargo via HAN. By mastering these fees, you can transition from merely paying costs to actively controlling them.

Air freight: the foundation of your transportation budget

Understanding the rate structure (General Cargo Rates-GCR)

Air freight rates are standardized but structured into tiers based on weight. These tiers, published in the IATA TACT (The Air Cargo Tariff) manual, are designed to encourage shippers to consolidate volume.

| Rate Code | Description | Application |

| M | Minimum Charge | The lowest charge accepted by the carrier, regardless of the shipment’s actual weight. |

| N | Normal Rate | Applicable for shipments weighing less than 45 kilograms (KGS). |

| Q | Quantity Rates | Rates applied to shipments exceeding specified weight breaks (e.g., +45K, +100K, +300K, +500K, +1000K). The higher the weight break, the lower the per-kilogram rate. |

Beyond GCR, airlines may offer Specific Cargo Rates for high-volume commodities on certain routes (e.g., textiles, perishable goods) or Commodity Classification Rates (CCR) for high-value items (e.g., gold, artwork), which incur a higher rate due to increased liability.

The all-important chargeable weight calculation

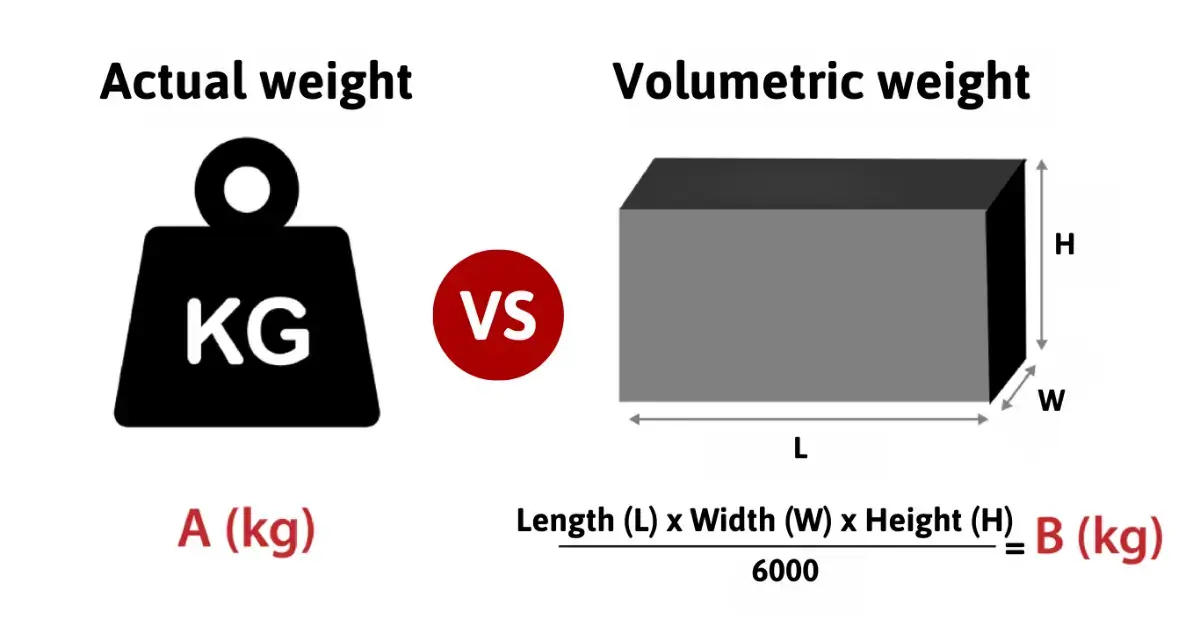

Air freight is always charged based on the Chargeable Weight (C.W.), which is the greater of two figures:

- Gross Weight: The actual weight of the cargo, including packaging, measured in kilograms (KGS)

- Volumetric Weight (Dimensional Weight): A calculated weight that accounts for the space the cargo occupies on the aircraft

Logistics Insight: If your goods are bulky but light (e.g., Styrofoam, clothing in large boxes), the volumetric weight will likely be your chargeable weight. Conversely, if your goods are dense and heavy (e.g., machinery parts), the gross weight will apply. Smart packaging optimization is a key strategy for lowering your C.W.

Key factors influencing the final air freight rate

– Carrier Selection: Major global carriers (e.g., Vietnam Airlines, Cathay Pacific, Korean Air) often have higher base rates but superior capacity and schedule reliability. Budget or freighter-only carriers might offer lower rates but with less flexibility

– Service Level: Direct flights are premium priced. Transit/Connecting flights are generally cheaper but involve longer transit times and higher risk of delays/offloading

– Market Dynamics: Air freight rates are extremely volatile, fluctuating based on fuel prices, global capacity, e-commerce seasonality, and geopolitical events

– Negotiation Power: For regular shippers, securing a committed rate from your freight forwarder or directly from the airline based on aggregated volume is the only way to achieve cost stability

Mandatory air freight surcharges: beyond the basic rate

Essential Security and Fuel Fees

| Surcharge | Abbreviation | Purpose | Volatility |

| Fuel Surcharge | FSC | Recovers the cost of aviation fuel, which is highly volatile. This is often the largest surcharge. | High |

| Security Surcharge | SSC / ISC | Covers the expenses related to enhanced security procedures, cargo screening (X-ray), and mandatory global security protocols. | Medium |

Logistics Data Point: As of recent trends, the combined FSC and SSC can often constitute 20% to 40% of the total air freight cost, depending on the route and the prevailing oil prices.

Other Potential Surcharges (Applicable to Specific Cargo)

– War Risk Surcharge (WRS): Applied to shipments passing through or near areas of heightened geopolitical conflict, as mandated by the airline’s insurance coverage

– Peak Season Surcharge (PSS): Imposed during periods of high demand, particularly Q3 and Q4 (September to December) for holiday and year-end inventory replenishment

– Dangerous Goods Fee (DGR): A fixed handling fee applied to shipments classified as Dangerous Goods, covering the extra administrative work and specialized loading/segregation required

– Valuation Charge (VAL): This is the fee for “Declared Value for Carriage.” If the shipper declares a value higher than the carrier’s standard liability limit (SDR 22/kg), an additional fee (usually a percentage of the excess declared value) is charged to cover the increased insurance risk

Critical Local Charges at HAN

Common Import Local Charges at Noi Bai (HAN)

When your cargo arrives at HAN, these are the charges you, or your consignee, must pay to take possession of the goods:

| Local Charge (Import-HAN) | Abbreviation | Description | Charged By |

| Terminal Handling Charge | THC | Cost for the ground handler (e.g., VIAGS) to unload the cargo from the aircraft and move it to the terminal warehouse. | Ground Handler/Airline |

| AWB/Document Fee | DOC | Administrative fee for processing the Air Waybill and related commercial invoices/packing lists. | Forwarder/Airline |

| Storage | Fee for holding the cargo in the airport warehouse beyond the specified free time (usually 24-48 hours). A major cost risk. | Ground Handler | |

| Handling Fee/Delivery Order | D/O Fee | A fee charged by the forwarder to issue the Delivery Order, authorizing the consignee to retrieve the goods. | Forwarder |

Common Export Local Charges at Noi Bai (HAN)

For cargo leaving HAN, the shipper pays these charges to ensure the goods are accepted and loaded onto the aircraft:

| Local Charge (Export-HAN) | Abbreviation | Description | Charged By |

| Terminal Handling Charge | THC | Cost for receiving, weighing, measuring, and moving the cargo from the forwarder’s depot to the carrier’s aircraft. | Ground Handler/Airline |

| Security Screening Fee | X-Ray Fee | Mandatory fee for the physical screening (X-ray) of the cargo to comply with aviation security standards. | Ground Handler |

| AWB & AMS | DOC | Administrative cost for preparing the House AWB and processing export documents. | Forwarder |

Customs, ground logistics & regulatory fees

Official customs clearance fees (duties and taxes)

These are government-mandated levies based on the cargo’s nature and value.

- Import/Export Duties: Calculated based on the commodity’s HS Code (Harmonized System Code) and the declared value (CIF value for imports)

- Value Added Tax (VAT): The prevailing VAT rate in Vietnam (typically 8% or 10%) applied to the total dutiable value (CIF + Import Duty)

Crucial Point: The accuracy of the HS Code and the declared customs value (valuation) are paramount. Errors can lead to penalties, forced re-assessment, and significant delays, incurring high storage/demurrage fees.

Trucking and transportation costs

These are the inland logistics costs for moving the goods to or from the airport perimeter.

- Pre-carriage (Export): The cost of trucking the cargo from the factory/shipper’s warehouse in Hanoi or surrounding provinces to the HAN air cargo terminal

- On-carriage (Import): The cost of trucking the cleared cargo from the HAN terminal to the consignee’s final warehouse/destination

- Toll Fees & Handling: Additional charges for expressway tolls, and labor/forklift costs at the warehouse for loading/unloading the truck

Special licensing and permit fees

For goods that are not standard general cargo, regulatory compliance is a mandatory cost.

- Customs Brokerage Fee: The service fee paid to a licensed Vietnamese customs broker (often your freight forwarder) to prepare, transmit, and manage the customs declaration dossier (e.g., VNACCS/VCIS system).

- Specialized Inspection Fees: Costs related to mandatory checks for specific goods, such as:

- Quarantine Inspection: For foodstuffs, plants, or animal products.

- Quality Inspection/Conformity Declaration: For specialized machinery, IT/telecom equipment, or consumer electronics requiring Vietnamese certification (e.g., Circular 04, Circular 05).

- CO/CQ Acquisition: Fees associated with obtaining official documentation like the Certificate of Origin (C/O) to qualify for preferential duty rates under Vietnam’s various Free Trade Agreements (FTAs).

Navigating the air freight logistics landscape at Noi Bai International Airport requires more than just quoting the basic rate. Shippers and businesses must possess a holistic understanding of the Air Freight, Surcharges, Local Charges, and Customs/Regulatory Fees. By adopting a proactive, informed approach to these four pillars of cost, you can optimize your supply chain, enhance your competitive edge in the Vietnamese market, and transform logistics from a cost center into a strategic advantage.

Contact Fastrans today for a comprehensive, no-obligation cost analysis for your next import or export shipment.