Simplified procedure for C/O form AK application: fast-track your exports

South Korea currently stands as one of Vietnam’s top trading partners, offering immense opportunities for exporters. Under the framework of the ASEAN-Korea Free Trade Area (AKFTA), goods originating from Vietnam can enjoy significant preferential treatment, with import duties often slashed to 0%. However, the “golden ticket” to these tax savings lies in a single, critical document: the Certificate of Origin (C/O) Form AK.

For many companies, securing this document can be a daunting task. Complex Rules of Origin (ROO), strict documentation requirements from the Ministry of Industry and Trade (MOIT), and the fear of rejected shipments often turn the application process into a bottleneck. A simple error in the HS Code or a miscalculated Regional Value Content (RVC) can lead to weeks of delay and thousands of dollars in unexpected tax costs.

You don’t need to navigate this maze alone. Drawing from practical experience in freight forwarding and customs brokerage, this guide presents a simplified procedure for C/O form AK application updated for 2025. Whether you are a seasoned exporter or shipping to Incheon for the first time, this step-by-step walkthrough will help you streamline your paperwork, ensure compliance on the Ecosys system, and clear customs with confidence.

Pre-requisites: laying the groundwork for success

Before logging into the system, meticulous preparation is required. A “rejected” C/O often stems not from the application itself, but from the lack of groundwork in this phase.

System registration

If this is your first time applying for a C/O, you must register a Profile with the issuing authority.

- The System: Most C/O Form AK applications are processed via the Ministry of Industry and Trade’s Ecosys system (ecosys.gov.vn).

- Requirement: You need to upload your Business License, Tax Registration, and register the specimen signatures of your Board of Directors.

- Digital Token: Ensure your Digital Signature (USB Token) is active and compatible with the system for electronic signing.

Strategic HS code classification

One of the most common causes of customs disputes is a mismatch in HS Codes.

- The Rule: While the C/O is issued based on the Export HS Code (Vietnam), the preferential tariff in Korea is determined by the Import HS Code.

- Expert Tip: Before shipping, confirm the HS Code with your Korean partner. If there is a difference (e.g., Vietnam uses 8544.42 but Korea uses 8544.49), consult with the MOIT officer. Often, you can declare the HS Code on the C/O at the 6-digit level (International Standard) to satisfy both sides.

Determine the Origin Criteria (The “Soul” of the C/O)

You cannot simply “choose” a criterion; you must prove it.

- Wholly Obtained (WO): Strictly for agricultural products grown or harvested entirely in Vietnam (e.g., dragon fruit, coffee beans).

- Regional Value Content (RVC): The standard threshold for AKFTA is RVC 40%. You must prepare a Costing Sheet proving that at least 40% of the FOB price originates from AKFTA member countries.

- Change in Tariff Heading (CTH): Used when imported non-originating materials undergo a significant transformation in Vietnam, changing their HS Code at the 4-digit level.

- Form AK vs. Form VK: Don’t forget to check the VKFTA (Vietnam-Korea FTA). Sometimes, Form VK offers a better tax rate or easier rules for specific textile or mechanical products. Always compare before you apply.

The simplified procedure for C/O form AK application

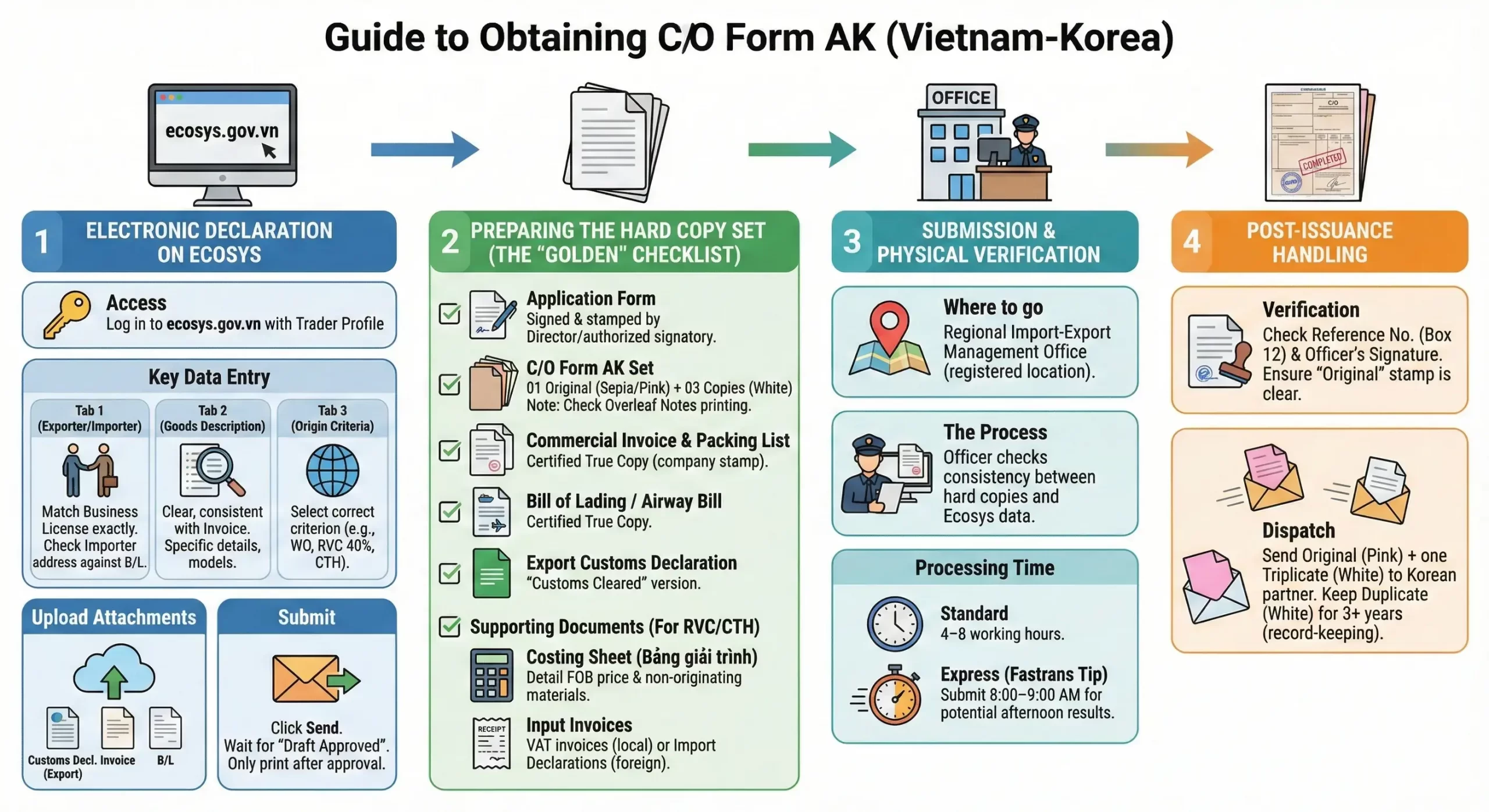

Navigating the bureaucracy of C/O application can be overwhelming. To help you “clear customs” faster, we have distilled the process into 4 streamlined steps as below:

Common pitfalls & How to fix them?

The Description Trap

The Problem: The description of goods on the C/O does not strictly match the Bill of Lading (B/L) or Commercial Invoice.

The Fix: While the C/O allows for a general description, major differences will trigger a “Red Channel” inspection in Korea.

Fastrans Tip: Ensure the Shipping Mark and Gross Weight on the C/O match the B/L exactly. For the product description, if the B/L is too technical, use a general commercial name on the C/O but ensure it links back to the Invoice number declared

Invalid Origin Criteria (RVC Calculation Errors)

The Problem: The system rejects your application because the Regional Value Content (RVC) is below 40%, or the calculation is illogical.

The Fix: Common mistakes include using the Ex-Works price instead of the FOB price as the denominator, or failing to deduct the value of non-originating materials correctly.

“Issued Retroactively” (Late Applications)

The Problem: Your vessel departed 4 days ago, but you are just now submitting the C/O.

The Fix: According to AKFTA rules, a C/O issued more than 3 working days after the shipment date is considered “Retroactive.”

Action: You must tick the “Issued Retroactively” box (Box 13). If you forget this tick mark, the C/O is invalid, and your customer will be denied preferential tariffs.

Third Country Invoicing (The Middleman Scenario)

The Problem: You export from Vietnam to Korea, but the Sales Contract and Invoice are issued by a trading partner in a third country (e.g., Singapore, USA, or even China).

The Fix: This is fully permitted under AKFTA, provided you declare it correctly:

- Box 13: Tick “Third Country Invoicing”.

- Box 7: You must explicitly state the Legal Name and Country of the company issuing the invoice (e.g., “Invoice issued by: Global Trade Ltd, Singapore”).

- Box 10: Enter the Invoice number issued by that third-party company.

Why partner with a professional logistics provider?

In the world of international trade, compliance is not just about paperwork-it is about profit margins. Many businesses attempt to handle C/O applications in-house to save a small service fee. However, without a dedicated compliance team, the risks are high:

- Retrospective Tax Collection: If a C/O is found invalid during a post-clearance audit (up to 5 years later), the importer must pay back all saved taxes plus heavy penalties.

- Demurrage & Detention: A rejected C/O often means the cargo sits at the Korean port waiting for a corrected document, incurring massive storage fees.

The Fastrans Advantage

Partnering with a specialized logistics provider like Fastrans transforms these risks into reliability. We don’t just “submit papers”; we provide strategic consultancy:

- HS Code Optimization: We analyze your product to find the most beneficial HS Code that satisfies both Vietnam and Korea customs.

- RVC Pre-calculation: Our team helps you verify your Costing Sheet before production to ensure you hit the 40% threshold.

- Crisis Management: When an application is rejected, we know exactly which officer to contact and how to explain the technicalities to get it approved immediately.

Ready to streamline your exports to Korea?

Don’t let paperwork delay your success. If you have questions about the latest AKFTA tariff schedule or need a quick check on your RVC calculation, leave a comment below or contact the Fastrans team today. We are here to ensure your cargo-and your documents-flow smoothly.